Take control of your next step with a flexible personal loan that puts you in charge.

Save time by using your NetBank details.

Available for a limited time when you apply and fund an Unsecured Fixed Rate or Unsecured Variable Rate Personal Loan between 05 August and 10 October 2024 .~

Know you’re getting the rate that is personalised according to your circumstances.

Complete the online application in about 15 minutes, and get a response in as little as 60 seconds.

You could receive the funds on the same day you apply (if eligible)^.

Fixed Rate Loan

FeaturesSave $250 with no establishment fee on Fixed Rate Personal Loans when you apply and fund between 05 August 2024 and 10 October 2024 ~

Variable Rate Loan

FeaturesSave $250 with no establishment fee on Variable Rate Personal Loans when you apply and fund between 05 August 2024 and 10 October 2024 ~

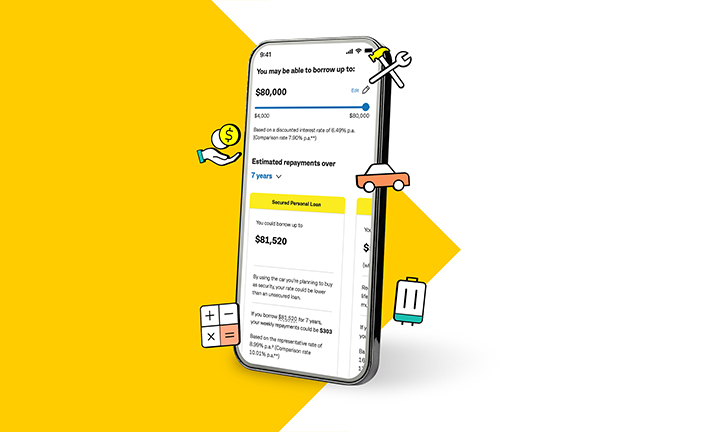

Secured Personal Loan

FeaturesUse our borrowing power calculator, and quickly and easily get a better understanding of:

Buy your dream car, whether it’s new or used

Cover your electric vehicle and charging station needs

Streamline your finances and better manage your debt

Design your dream home, whether you’re looking to renovate or redecorate

Unlock potential savings with energy-efficient products for your home

Cover your travel costs when you’re planning your dream getaway

Invest in your future and cover your education expenses

Wedding, baby, medical expenses or other personal investments

Apply online. It will take about 15 minutes and we’ll ask you some details. You can also apply over the phone or in branch

After you submit, we’ll give you a response in 60 seconds

If approved, we’ll send you a contract. Accept the contract if you’re happy with the terms

We may ask you for some additional documents

Get a discounted interest rate on eligible energy-efficient purchases starting from 7.50% p.a. on Unsecured Fixed and Variable Rate loans and 6.49% p.a. on a Secured loan. Comparison rates start from 8.54% p.a. for Unsecured Fixed Rate and Variable Rate loans. Comparison rates are 7.90% p.a. for Secured loans.

Whether it's a new or second-hand car, a personal loan can help you pay for your car if you don’t have the funds up front. Buying a car

Whether you're planning a vacation or a staycation, a personal loan can help you achieve your travel goals. Plan your travel

Having a number of debts can be a worry, but there are ways to manage your debt and stay on top of your finances. Debt consolidation

Browse cars, apply for finance and get the most from your car. And you can enjoy special offers for CommBank customers.

Estimate how much you can borrow and work out the repayments at the current interest rate. Use borrowing calculator

Understand what your repayments will be. Adjust the term and the amount to meet your budget. Use calculator

Use our comparison tool to see the estimated running costs, emissions and vehicle prices of an EV compared to a petrol, diesel or hybrid vehicle. Get started

Quick guide to taking out a personal loan

Things you'll need to apply for a personal loan

Tips for getting your personal loan approved

~ Offer available for a limited time. Apply and fund an Unsecured Fixed Rate or Unsecured Variable Rate Personal Loan between 5 August 2024 and 10 October 2024 to save $250 on the establishment fee (comparison rate calculations are inclusive of this offer).

We reserve the right to close or vary this offer at any time.

1 Additional repayments made on fixed rate and secured personal loans are not available to be redrawn. An early repayment adjustment is charged if loan is fully repaid with 12 or more months remaining on loan term, and we reasonably estimate we will incur a loss or administrative cost. View the Personal Loan Terms and Conditions.

Your interest rate is based on a number of factors, including the information you provide and our assessment of your application. We'll confirm your interest rate in your loan offer document.

Unsecured Fixed Rate Personal Loan interest rate ranges and the representative rate are set out below. Comparison rates and examples are based on a $30,000 unsecured fixed rate loan over 5 years:

Unsecured Variable Rate Personal Loan interest rate ranges and the representative rate are set out below. Comparison rates and examples are based on a $30,000 unsecured variable rate loan over 5 years:

Secured Personal Loan interest rate ranges and the representative rates are set out below. Comparison rates and examples are based on a $30,000 secured loan over 5 years:

2 Interest rates at the lower end of our range, for example 8.50%/8.50%/6.99% p.a. (comparison rate 9.53%/9.53%/8.40% p.a.), may be offered to customers with an excellent credit history.

An excellent credit history is determined by, among other things, paying your bills and making loan repayments on or ahead of time, being disciplined with your credit applications, and not overextending yourself financially.

Actions which can negatively impact your credit history include missing bill or loan repayments, defaulting on your credit facility, or making a large number of credit applications in a short period of time. You can find out more about how your credit score is calculated and tips for improving your credit score at our Credit Score Information Hub.

3 At least half of our customers will receive the representative rate or lower. It may not be the actual rate you receive.

Your interest rate may be different and is based on a number of factors, including your credit history, the information you provide and our assessment of your application. We'll confirm your interest rate upon submission of your application.

^ You may be eligible for same-day funding if you’re approved, accept your contract and complete verification by 4pm Monday to Friday (Sydney/Melbourne time). Subject to credit checks and assessment of your financial situation. Unavailable if an application is incomplete or needs to be referred for a more detailed review by a lending specialist, or if required documentation isn’t provided, and subject to system availability.

To find out more details about the award CommBank has received from Canstar, please go to https://www.canstar.com.au.

WARNING: This comparison rate applies only to the example or examples given. Different amounts and terms will result in different comparison rates. Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the comparison rate but may influence the cost of the loan.

Applications for finance are subject to the Bank’s normal credit approval. View the Personal Loan Terms and Conditions. Full terms and conditions will be included in our loan offer. Fees and charges payable. Commonwealth Bank of Australia ABN 48 123 123 124. Australian credit licence 234945.